Updated for 2026

Offering health benefits is a powerful way to attract and keep great employees. But for many California small businesses, the process feels expensive and complicated. A newer, more flexible option called ICHRA (Individual Coverage Health Reimbursement Arrangement) is changing that, making it easier and more affordable to provide pre-tax health benefits.

This guide walks through your options for small business health insurance in California. We'll break down how ICHRA works and compare it to traditional group plans to help you make the best choice for your team.

Why is Affordable Small Business Health Insurance so Hard to Find in California?

ICHRA provides a solution to a problem that’s plagued small businesses for years. Group insurance plans work well for big corporations because they’re specifically designed to work best for companies with lots of employees. But for a 15-person business in Los Angeles or a startup in San Diego? Not so much.

For businesses with fewer than 50 employees, and especially those with under 10 or 20, several challenges make these plans a tough fit.

- High Costs: The average annual cost in 2025 is $9,325 for single coverage and $26,993 for family coverage. With premiums rising, budgeting becomes a major hurdle.|

- Time Commitment: Finding and setting up a group plan is not a quick process. It often involves a lengthy sales cycle that can take over 60 hours and span several weeks or even months, time most small business owners simply don't have.

- Strict Participation Criteria: Even if you make the time to haggle with insurance companies and find the budget to cover those prices, you can still be stymied by the minimum participation criteria. Many group plans require at least 70% of employees to opt in. If your employees have their own tight budgets, that may be an insurmountable barrier.

Comparing Your Health Benefit Options

As a California small business with fewer than 50 employees, you aren't legally required to offer health coverage. However, providing benefits is a competitive advantage. Here’s a breakdown of your three main choices..

1. Traditional group health insurance plans

This is the classic model where you work with a broker to select one or a few plans to offer your entire team.

Pros:

- It’s predictable (at least in the short term). You can trust your costs to stay consistent for the year.

- Plans must offer a reasonable standard of care. Group insurance plans must adhere to all state regulations, which outline the standards of coverage they must meet.

- It’s good for recruitment and retention. A strong benefits package makes your job offers more appealing.

Cons:

- Very expensive. The cost is often the biggest barrier for small businesses.

- Budgeting is unpredictable. Insurance premiums often go up year after year, making costs hard to predict beyond a year. And if one employee has high medical costs this year, premiums for the whole company could go up next year.

- Limited employee choice. With this model, employees have little say in the details of their plan and the network it covers.

- High participation rates are required. If your employees don’t all want to enroll, you may not be able to qualify.

- Administrative Burden: The setup and annual renewal process is time-consuming.

2. Giving employees a cash stipend (wage increase)

If group plans feel out of reach for your small business, you may figure that providing that same amount in cash should do the trick. Employees still get the benefit and can choose to spend it how they see fit. It seems like a basic enough idea on the surface, but there are some unintended downsides in practice.

Pros:

- Cash is easy. You can skip dealing with salespeople, doing research, and managing paperwork. All you have to do is add some extra money to each employee’s paycheck.

- You control the budget. You can’t control health insurance rates, but you can control how much cash you give employees.

Cons:

- They may not use it for insurance. You can tell employees that extra money is meant for health insurance, but they may just choose to pocket it instead. If an employee then experiences a medical emergency, they won’t have the coverage they need.

- They have to pay taxes on it. This is the biggest flaw. A large portion of the money is lost to taxes before your employee can use it. Supplemental wages in California are subject to a 6.6% state tax, 15.3% for FICA, and 22% for federal income tax. Nearly half the benefit disappears.

3. Pre-tax, fixed health benefit (ICHRA)

An ICHRA is a modern, tax-efficient solution to offering health benefits. You offer employees a fixed, tax-free allowance each month. They use that money to purchase an individual health insurance plan that fits their needs.That makes it a much better deal for both the business and employee.

Pros:

- Complete budget control. You set the allowance amounts based on what your business can afford. Your costs are predictable and will not increase unexpectedly.

- It’s specific to health insurance. Employees who opt to use the benefit must put it toward a health plan, so there’s no confusion about the benefit they’re receiving.

- There’s no minimum participation rate with ICHRA. Whether one employee enrolls or all of them do, it works. This is ideal for small business health insurance for under 10 employees in California, where meeting a 70% threshold is tough.

- Flexible & Fair: You can offer different allowance amounts to different employee groups (e.g., full-time, salary, part-time, hourly).

- Total employee choice. Each employee can select the health plan that best meets their needs.

- It allows employee privacy. You don’t need to be directly involved in your employees’ healthcare decisions. ICHRA lets you provide the benefit, while letting them handle all the details themselves.

- It’s easy. ICHRA requires far less time and work for small business owners than setting up a group health plan. Get that time back, while still taking care of your employees.

Cons:

- Requires employee action. Employees are responsible for researching and choosing their own plans, which can feel overwhelming for some. (Some ICHRA platforms offer free consultations with a broker.)

- Individual plans can have their limits. The quality and cost of individual plans can vary by location, and some may not be as robust as the top-tier corporate plans offered by large companies.

All Bronze Plans Now HSA-Eligible

Starting in 2026, there’s even more flexibility for employees choosing coverage through the individual market: all ACA Bronze health plans will become HSA-eligible. This means employees can pair a Bronze plan with a Health Savings Account, resulting in additional tax benefits and ways to save for healthcare costs. This is great news for small business owners and employees alike, creating more ways to maximize the value of health coverage and personal savings.

Learn more about this important update in our blog: Big News for 2026: Every ACA Bronze Plan Will Be HSA-Eligible.

Solutions for California Businesses Under 10 and 20 Employees

ICHRA is particularly effective for very small businesses that struggle with the rigid requirements of group plans.

Small Business Health Insurance for Under 10 Employees in California

For a business with just a handful of employees, group plan participation minimums are nearly impossible to meet. If you have five employees and a plan requires 70% participation, you need four to enroll. If two already have coverage through a spouse, you’re out of luck. An ICHRA has no minimums, making it a perfect fit. It allows you to offer competitive small business health benefits in California without being disqualified on a technicality.

Small Business Health Insurance for Under 20 Employees in California

As you grow to between 10 and 20 employees, group plans become slightly more accessible, but costs and administrative work remain significant barriers. An ICHRA scales with you. It gives your growing team the freedom to choose their own coverage, which can be a major selling point. You maintain control over your benefits budget during a critical growth phase while still taking care of your people.

How Employees Use ICHRA with Covered California

For employees to take advantage of ICHRA, they’ll need to select a qualified healthcare plan. In California, the best way to do that is via the Covered California marketplace. The marketplace makes it easy for employees to find all the available health insurance plans in their area that meet the Affordable Care Act (ACA) requirements.

Major health insurance carriers available on the marketplace include:

- Aetna CVS Health

- Ambetter from Health Net

- Anthem Blue Cross

- Blue Shield of California

- Kaiser Permanente

- LA Care

- Molina Healthcare

- Sharp Health Plan

It's important to note that carrier availability and plan options vary significantly by county. An employee in Los Angeles will see different plans and prices than an employee in San Francisco or a more rural area.

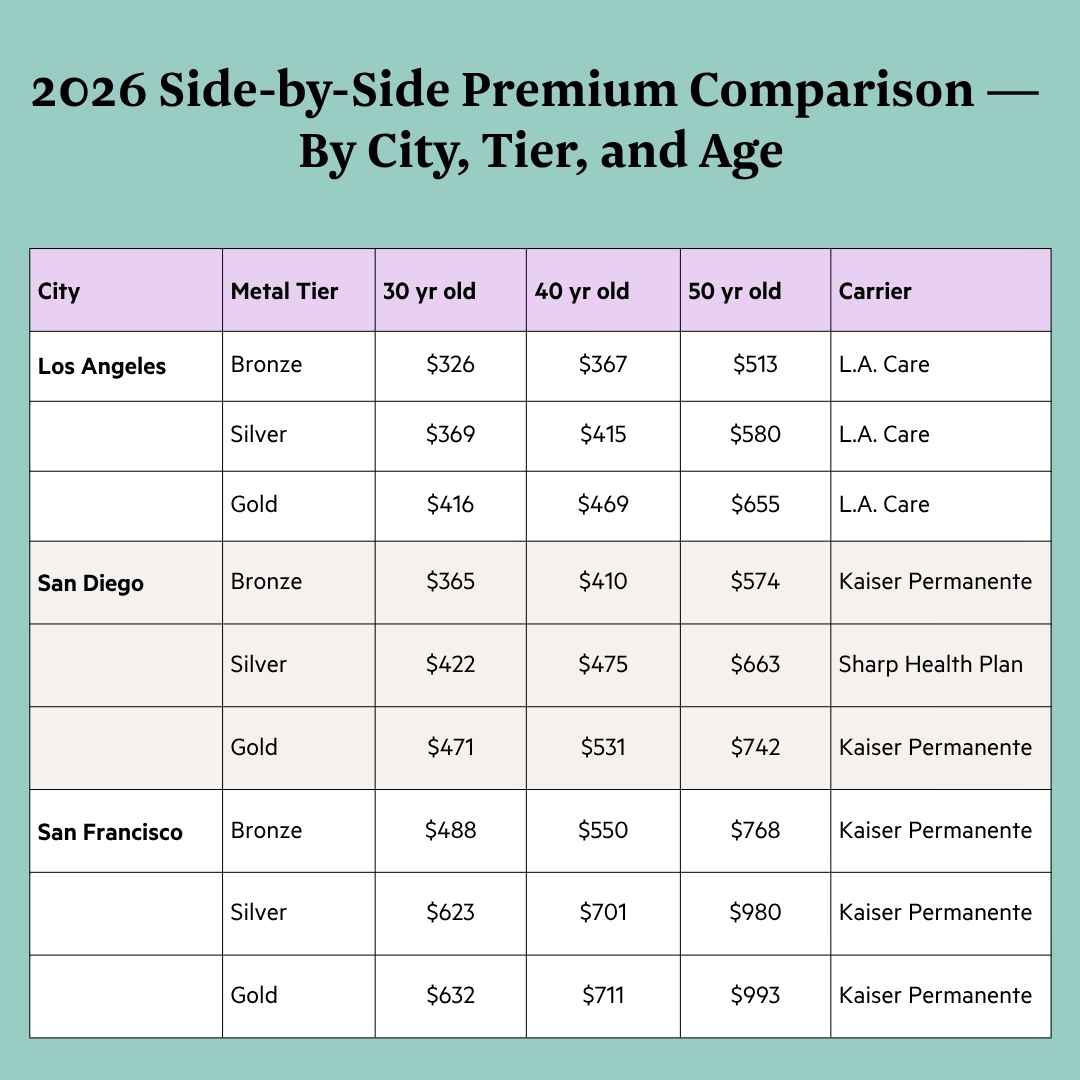

2026 California Health Insurance Cost Examples

California is a big state. The health insurance options and costs vary a lot between different counties and cities. That’s in addition to cost differences based on age and plan tiers. While we can’t tell you exactly what to expect a health plan for each employee to cost, we can provide a general idea.

Below are updated 2026 snapshots to help small business owners compare options for their teams.

- Bronze Plans: Lowest monthly premium, best for healthy individuals who want major medical protection. Higher deductibles and out-of-pocket costs.

- Silver Plans: Balanced option with moderate premiums and coverage.

- Gold Plans: Higher monthly premium, lowest deductible and copays. Best for those expecting frequent medical care.

Frequently Asked Questions: ICHRA and California Small Business

1. Who is eligible to offer an ICHRA in California?

Any size business can offer an ICHRA. It's an especially good option for small businesses that find traditional group plans too costly or complex. You cannot offer the same class of employees both a group plan and an ICHRA.

2. How much does it cost to offer small business health benefits in California?

You set the monthly tax-free allowance based on your budget. You can contribute as much or as little as you want, giving you full control over your budget. Every ICHRA administrator has different fees. StretchDollar's pricing is just $40/mo— the most affordable platform fees around.

3. Are there minimum participation requirements for an ICHRA?

No. Unlike many group plans that require around 70% of employees to participate, an ICHRA has no minimum participation requirements. This makes it an option even if only one employee wants to enroll.

4. How long does it take to set up an ICHRA?

Setting up an ICHRA is fast. With a provider like StretchDollar, you can have your health benefit plan up and running in about 10 minutes. This is a big advantage over the 60+ hours and multiple weeks it often takes to set up a traditional group plan.

5. Can I offer different benefit amounts to different employees?

Yes, you can offer different allowance amounts to employees based on defined employee groups, such as full-time, part-time, salary and hourly. However, you must offer the same amount to all employees within a specific group.

6. Do my employees have to use Covered California?

Employees must have a qualifying health plan to use their ICHRA funds. Using Covered California is often the best way to compare all available options.

7. Is an ICHRA a good option for a business with under 5 employees?

Absolutely. An ICHRA is one of the best solutions for very small businesses in California. It provides a formal, tax-advantaged benefit without the high costs or participation hurdles associated with group insurance.

Find the Best Health Benefit for your California Small Business

Navigating the world of employee benefits no longer has to be so complicated or expensive. An ICHRA provides a simple, flexible, and affordable way to offer valuable small business health benefits in California, helping you care for your team and grow your business.

Ready to see how a pre-tax fixed health benefit could work for you?

- Read our complete guide to ICHRA to learn more.

- If you have questions, contact our team for support.

- Get started with StretchDollar today and launch your benefits in minutes.

Article Source: KFF 2025 Employer Health Benefits Survey